New analysis: Cycling earns its place in COVID-19 recovery plans

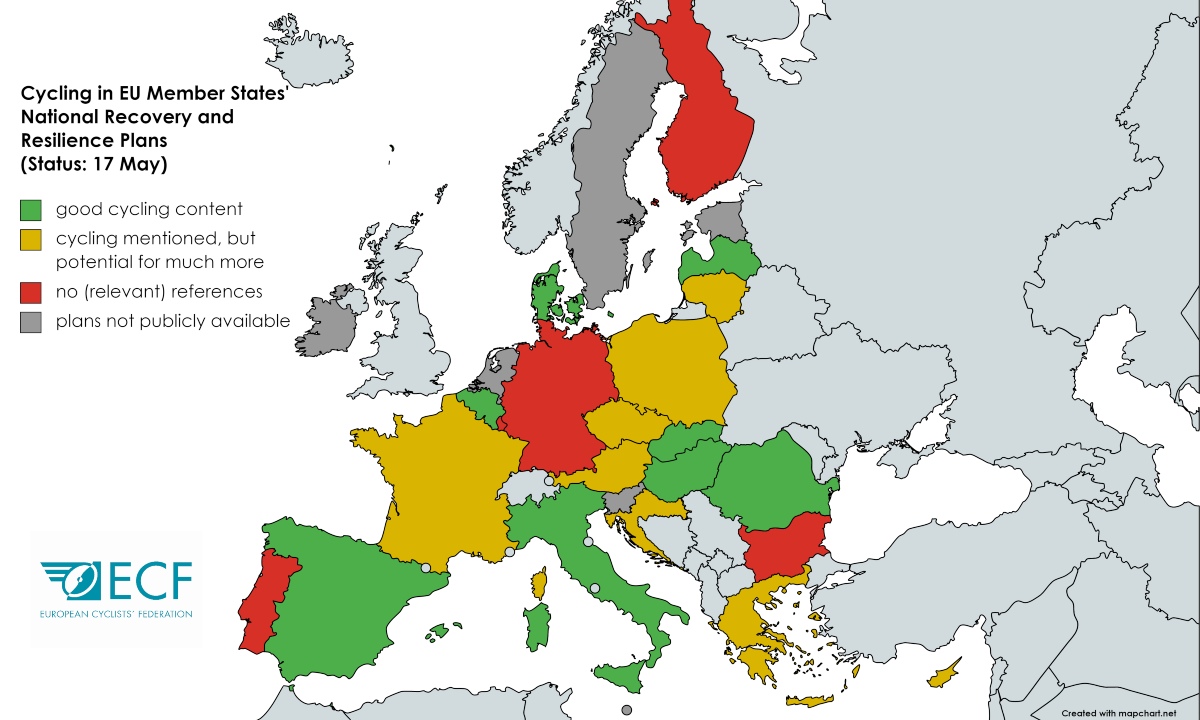

Since ECF’s analysis in April, cycling investments have become increasingly prominent in EU Member States’ recovery plans. However, while several countries have stepped up in recognition of the importance of cycling for post-pandemic recovery, there is still much room for improvement.

Following numerous advocacy campaigns and public consultations conducted in EU Member States, cycling has featured more prominently in several updated National Recovery and Resilience Plans (NRRPs). Since a previous analysis made by the European Cyclists’ Federation (ECF) in April 2021, multiple Member States have now included well-detailed and concrete targets for cycling, while also increasing long-term investments in infrastructure and projects (see table at bottom of article).

The updated NRRPs mark a major success for cycling advocacy in Europe, indicating that the major growth in cycling experienced during the pandemic will continue as EU countries return to normality. However, there are also reasons for concern, with several countries continuing to underperform and some even backtracking on earlier commitments to cycling.

Notable improvements in national recovery plans

Many countries’ submitted recovery plans now concretely define their proposed expenditure on cycling.

For example, the Czech Republic has announced €23 million for the improvement of vulnerable road users’ safety; Denmark has designated €70 million for cycling and e-cycling infrastructure and bicycle subsidy schemes for municipalities; Hungary has included €411 million for the “Development of regional transport networks”, which includes EuroVelo-compliant bicycle routes (260km) and a 950 metres-long bridge over the Danube with cycle tracks on each side; Latvia has confirmed its commitment to improve cycling infrastructure with an investment of €34.5 million; Slovakia has increased its cycling investments by €5 million since the previous draft, declaring €105.1 million for the “support of bicycle transport”, while also setting more specific targets and emphasis on secure separated bicycle infrastructure in urban and extra-urban areas.

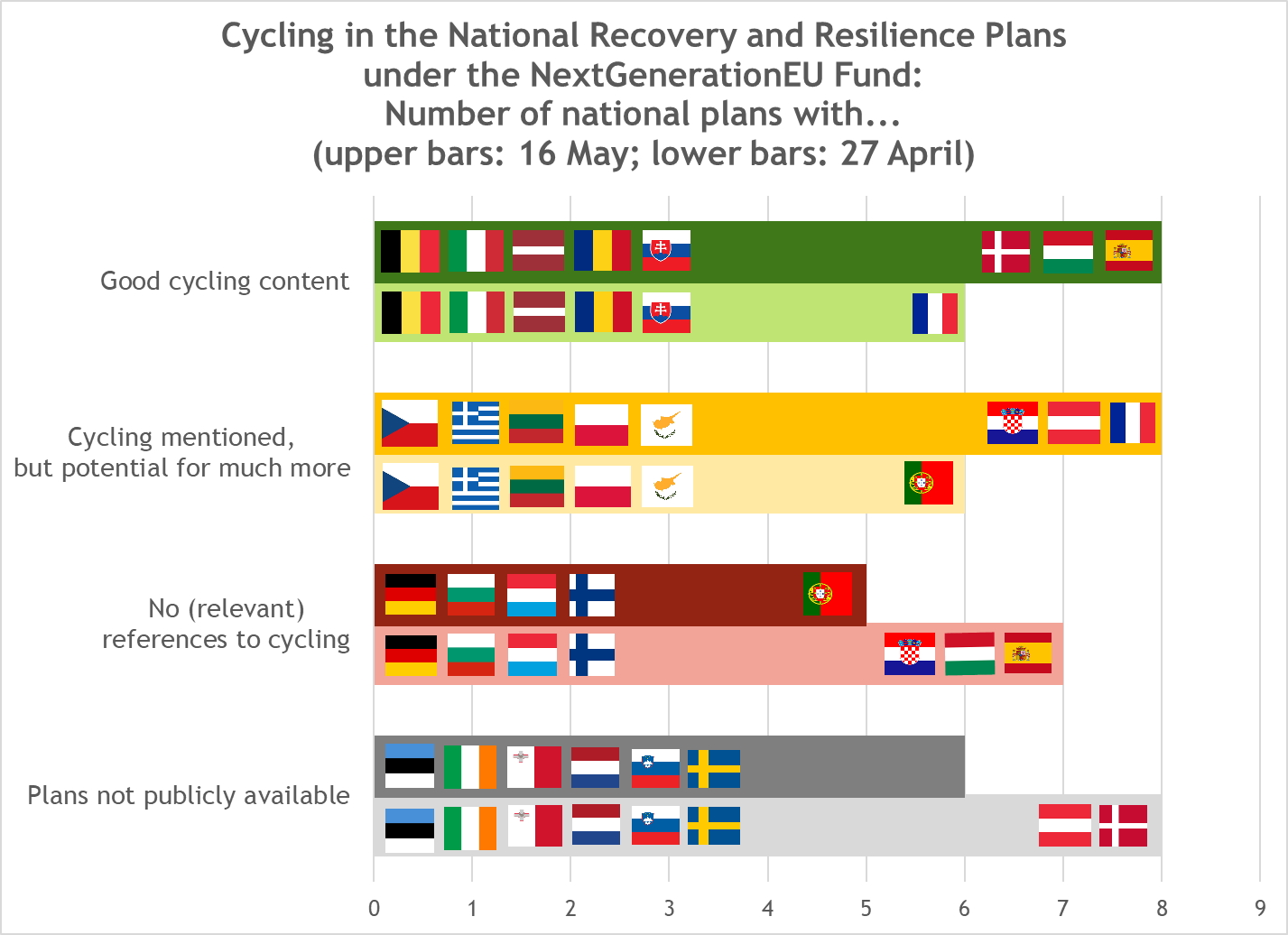

Graph showing best performers for cycling inclusion - and how that has changed from 27 April to 16 May 2021.

Spain recently declared that €3 billion will be dedicated to the creation of low-emission zones, pedestrian routes and the promotion of cycling. This commitment would put Spain at the forefront of EU countries dedicating NextGenerationEU funds towards cycling investments, earning it a place in the “good cycling content” category.

References to e-bikes are now present in the plans of Austria (purchase incentives for e-bikes and cargo bikes), Spain (e-bike sharing schemes in urban areas), Denmark (€1.4 million for e-bike recharging infrastructure) and Czech Republic (1,000 cargo bikes purchase incentives for businesses). On the other hand, in both France and Portugal’s plans, e-bike supporting projects are cited only as past or ongoing measures, without effectively inserting it in future investments.

Many plans are focusing on the interconnection of cycling and public transport, which together can represent a valid competitor to cars. Slovakia has increased the planned number of secure parking shelters for bicycles at railway stations (5,000), which will improve the quality of transfers between cycling and rail transport; the Belgian region of Flanders has vowed to invest in “Hoppinpunten” mobility points to stimulate multimodality; while Poland has mentioned a coherent network of bicycle paths and parking integrated with public transport.

Regional cohesion and connectivity are also regularly cited. Hungary is planning to strengthen regional cohesion through the development of EuroVelo routes and cycling bridges, “which are used both by tourists and commuters, underlining the importance of those routes to connect territories and remote areas”. The same idea is proposed for the development of “bike corridors” in Wallonia (Belgium).

Finally, with regard to tourism, Croatia has answered ECF’s call to capitalise on its potential for cycle tourism, inserting a €120 million investment for the development of “high-value tourism products”, which includes more cycling infrastructure and active tourism promotion. This also includes the application of digital solutions in data monitoring for the rental and use of bicycles.

Other interesting features that appear in the latest NRRP drafts include Belgium putting €5.6 million towards the development of MaaS (Mobility as a Service), which may have indirect positive effects if it includes cycling; Denmark setting aside funds for testing road pricing schemes, which contribute to the internalisation of the external costs of motorised transport; and France adding a reform to regulate secure cycling parking in stations and the development of bicycle carriage on trains.

The influence of public consultations and recognition of the benefits of cycling

As explicitly stated by some Member States, cycling content has been introduced or reinforced in their NRRPs after public consultation processes, confirming a rising interest and positive public consensus regarding cycling. For instance, Slovakia has stated in its plan that “given the relevance of the comments, […] other measures have been integrated in the plan […] A frequent suggestion is to support green passenger transport, which is reflected in the component Sustainable Transport by supporting urban cycling and cycling infrastructure. Based on comments requiring the development of the regions, measures for the development of slow tourism were also included”.

It is also worth noting that in the updated plans, cycling investments are increasingly justified not only for their climate-friendly characteristics in terms of urban mobility, but for many other social aspects and benefits, such as the following.

- Gender equality: The Czech Republic has taken into account the different ways of moving of men and women when investing on cycling infrastructure, while Belgium has brought attention to the increase of women's access to cycling mobility.

- Social inclusion: Belgium has also mentioned how the development of cycling infrastructure provides employment opportunities for the most vulnerable categories of workers, while Slovakia has mentioned how cycling infrastructure has wider effects on accessibility, health and productivity, stating “the construction of cycling infrastructure will create jobs and unlock the possibility of cycling as a cheap, fast and healthy alternative to commuting to work and short distance commissions, contributing to the greater inclusion of low-income groups.”

- Job creation and growth: Belgium has referenced the positive influence cycling has on economic growth, stating that “investing in cycling infrastructure leads to an increase in the demand for bicycles. As the market grows for bicycle manufacturers, the probability that related innovations will develop is greater. Trends in electrification, connectivity, MaaS and anti-theft technology, bike sharing, bicycle parking, etc. can unlock new customer segments and trigger a virtuous circle to further develop the market”.

This analysis is based on the finished plans submitted to the European Commission or on the latest available drafts for countries that have not yet submitted theirs. The Commission has so far received NRRPs (for which the submission deadline was 30 April) from 15 out of the 27 EU Member States and expects the remaining plans to arrive in the coming weeks.

|

No publicly available plans |

Estonia, Ireland, Malta, Netherlands, Slovenia, Sweden |

|

Not yet submitted |

Bulgaria, Cyprus, Czech Republic, Finland, Romania |

|

Submitted |

Austria, Belgium, Croatia, Denmark, France, Germany, Greece, Hungary, Italy, Latvia, Lithuania, Luxembourg, Poland, Portugal, Slovenia, Slovakia, Spain |

Some advice: All that glitters ain't gold!

Many improvements have been made in the latest NRRPs, with a higher presence of cycling and more detailed definitions for investment. However, even in the longer and updated drafts of some countries, there is still no direct mention to cycling investments. These include Bulgaria, Germany and Portugal, while in the last draft of the “France Relance” plan, previous mentions of cycling and active mobility investments have since been lost. Luxembourg has declared that the promotion of slow mobility is already ongoing in other projects, so instead have prioritised mobility electrification.

ECF strongly recommends for these countries to use the coming weeks of revision and submission of the final drafts to re-think mobility investments and (re)insert cycling in their recovery plans, as has happened with Spain, and offer our support for relevant advocacy campaigns.

Last but not least, even for the Member States represented in “green”, more ambition is always welcome. Having “good cycling content” in recovery plans does not necessarily mean there are no controversies or room to improve. For example, Italy’s current plan now has a defined and substantial amount of money addressed to cycling in absolute terms, but it is still less than 2% of the overall investment for infrastructure, with lower kilometres envisaged if compared with the previous government’s draft of January. Hungary also has good numbers on spending and kilometres, but their characteristics need to be better specified (are the “EuroVelo-compliant 260 km of bicycle routes” composed by new cycle routes or not? How much of the €411 million will go the Danube bridge and for cycling infrastructure?).

The case of Poland is also questionable, as cycling is mentioned in the "Transport safety” section, but out of the €700 million allocated for this component, an estimated €462 million is for building new roads. Poland’s plans for building a coherent cycling network integrated with public transport have been moved from grants to loans, making it less effective, as cities can easily get attractive commercial loans from elsewhere. Furthermore, the consultations section of the plan recognises many calls from regions, municipalities and non-governmental organisations for more funding for cycling infrastructure (e.g. cycle tourism in SPA areas), but despite these calls, have earmarked no clear funding for cycling.

What we expect is a systematic increase in the allocation of cycling investments overall funding streams, while also setting more and more ambitious targets for safe and convenient infrastructure to be implemented over the next decade. The case of Denmark in particular shows that investments need to be ambitious at an overall level, not only in the Recovery Funds. What would also be welcomed is more reforms and wider long-term visions, trying to not simply shift funds from regular pre-existing plans into the Recovery Plans.

NextGenerationEU is a historic occasion to “build back better.” It is vital that EU Member States capitalise on the current momentum for cycling to make Europe’s mobility system more sustainable in the long run. Member States must seize this opportunity to ensure more and better cycling for all.

Overview table of National Recovery and Resilience Plans and their links to cycling

|

|

State |

Description of cycling commitments in NRRP |

Investments in cycling* |

Km planned |

|

GOOD CYCLING CONTENT |

Belgium |

Dedicated investments of €746 million (55% covered by RRF) for cycling and walking infrastructure (bike sharing schemes, subsidies to local authorities for infrastructure development), with the aim to increase and coordinate efforts to develop safe cycling infrastructure (separate cycle paths and safer crossroads; attention to school environments); connectivity between cities and hinterlands with "bike corridors"; stimulate multimodality (with "Hoppinpunten": mobility points); Velo Plus project (cycle paths along the main roads, structuring and developing cycle routes along railways, canals, motorways. |

€411 million (7% of the RRF) |

188 (new), 1,356 (to renew) |

|

Denmark |

Dedicated component on “Green transportation and infrastructure”, with an e-bike infrastructure scheme, cycling infrastructure investments on main roads and bicycle subsidy scheme for municipalities to make cycling attractive especially outside urban areas, developing a coherent cycling network. |

€70 million (4.4% of RRF) |

|

|

|

Hungary |

Dedicated investment for the development of the EuroVelo-compliant bicycle routes (260km) especially for commuting purposes, to increase connectivity of remote areas and the competitiveness with the car, and a 950mt long Danube bridge with cycle tracks on both sides. |

|

260 |

|

|

Italy |

Dedicated investment for the "Reinforcement of cycling mobility", with plans for cycling infrastructure maintenance and the realisation of new 1,200km of touristic paths and c.~570km of urban cycle tracks. |

€600 million (0.3% of RRF) |

1,770 |

|

|

Latvia |

Development of cycling infrastructure for daily mobility with a unified, uninterrupted network to ensure local and neighbourhood connectivity and integration with the EuroVelo network. Integration of public transport, cycling infrastructure and micro-mobility to serve the last mile. |

€34 million (1.7% of RRF) |

|

|

|

Romania |

Construction, and operationalization of medium / long cycle routes, including EuroVelo routes, with the aim to create a national network; changing the legislation in force, by promoting a normative act on cycling routes. |

€120 million (0.9% of RRF) |

3,000

|

|

|

Slovakia |

Increase the share of cycling in the modal split by:

|

€105.1 million (1.7% of the RRF) |

200

|

|

|

Spain |

Execute plan for sustainable, safe and connected mobility in urban areas; improve e-mobility (incentive for bike sharing schemes); establish low emission zones and to guarantee connectivity of people who live in depopulated or remote areas. Recently declared €3.6 billion for sustainable mobility measures, of which 2.5 are going to Autonomous Communities and Local Entities. |

|

|

|

|

CYCLING MENTIONED, but potential for a lot more |

Austria |

Lacks concrete definition of cycling-related spending and projects. |

|

|

|

Croatia |

€120 million action for “high-value tourism products” which includes investments for cycling infrastructure and the protection and development of active tourism, also with attention to the application of digital solutions on data monitoring for the rental/use of bicycles. But still no definition of cycling spending, and absence of cycling in the transport section. |

|

|

|

|

Czech Republic |

Aims to reduce road fatalities with dedicated spending on road safety for vulnerable users (€23 million); sets modal share targets for active modes in the Sustainable Urban Mobility Plans (SUMPs); implements reforms on road traffic (e.g. safe distance when overtaking cyclists); purchase premiums addressed to businesses for the purchase of 1,000 e-cargo bikes |

€23 million (0.3% of RRF) |

|

|

|

France |

In the latest version of the plan, there is no longer any mention of specific cycling investments or active mobility in the transport component. The only clear mention to cycling is a reform for secure cycling parking in stations and the development of bike-on-train measures. |

|

|

|

|

Greece |

The plan largely speaks about green tourism / ecotourism / non-seasonal tourism but the only cycling-related investment is the development of walking and cycling routes in the forest of Tatoi |

|

|

|

|

Lithuania |

Cycling is now mentioned also in the component "Component "Development of a sustainable transport system" which includes the development of walking and cycling infrastructure, but it still lacks details in spending and concrete plans. Also it added the reform 'moving without polluting' which sets specific targets for e-cars but not e-bikes. |

|

|

|

|

Poland |

Punctual interventions to improve road safety, including cycling (in national roads). There are plans for building a coherent cycling network integrated with PT, but they have been moved from grants to loans. |

|

|

|

|

Cycling briefly mentioned without any real concrete plan: Cyprus, Portugal |

||||

|

MISSED OPPORTUNITIES |

Finland |

Its goal is carbon neutrality by 2035 and to become the first fossil-free state, but they do not mention cycling; an investment component is dedicated to "sustainable tourism". |

|

|

|

Germany |

€2.5 billion purchase premium for e-cars, but cycling is not mentioned once. |

|

|

|

|

Cycling ignored (no direct nor indirect references): Bulgaria, Luxembourg |

||||

|

Not publicly available info: Estonia, Ireland, Malta, Netherlands, Slovenia, Sweden |

||||

Regions:

Contact the author

Recent news!

Upcoming events

Contact Us

Avenue des Arts, 7-8

Postal address: Rue de la Charité, 22

1210 Brussels, Belgium