Final analysis: Cycling becomes mainstream in EU member states’ COVID-19 recovery plans

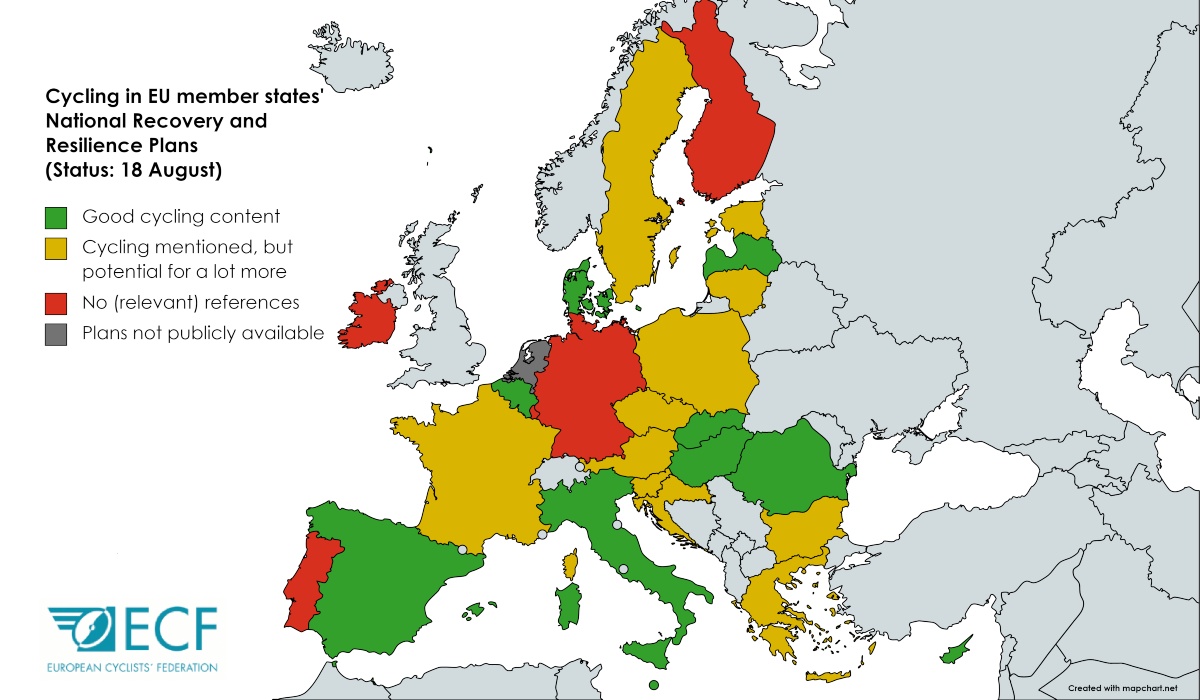

Since ECF’s last analysis, most EU countries now mention cycling in their COVID-19 recovery plans, with €1.7 billion earmarked for cycling infrastructure, safety, tourism and promotion, confirming its importance for Europe’s sustainable recovery.

Since April 2021, 25 member states have submitted their National Recovery and Resilience Plans (NRRPs) to the European Commission, outlining priorities for the funds that will be disbursed from the Recovery and Resilience Facility (RRF), which is part of the EU’s €750 billion COVID-19 pandemic recovery plan.

According to the General Dutch Press Agency (ANP), the two countries that have yet to submit their plans to the Commission are Bulgaria, which has published a draft but not submitted it yet, and the Netherlands, which wants to wait for a new government to form after the election that took place in March. In the meantime, some countries have already started receiving money from the Recovery Fund, including Belgium, Portugal and Luxembourg.

So what has changed since ECF’s last analysis in May?

New recovery plans

Five countries eventually published a recovery plan for the first time, with direct or indirect cycling content:

- Bulgaria includes measures for an urban mobility reform addressed to the implementation of infrastructure for safe urban mobility aimed at vulnerable road users, namely pedestrians and cyclists.

- Estonia includes investments for local authorities to use on walking and cycling infrastructure, with €5 million going to the development of 24km of cycling and walking paths. This includes: 1) completing walking and cycling connections with railway stations and public transport stops with the rest of the network; 2) developing paths outside larger urban areas to help eliminate unsafe bottlenecks for cycling.

- Malta envisages two reforms that indirectly include cycling. The first is the creation of more open and car-free spaces across Malta and the island of Gozo and the adoption and implementation of policies promoting the sustainability of the transport sector, including by encouraging the use of multimodal transport. The second is an investment directly aimed at the creation of purchase incentives for e-bikes in the private sector.

- Slovenia’s recovery plan section on sustainable mobility mainly focuses on rail and alternative fuels. However, cycling is mentioned in the sustainable tourism section, where investments in cycling trails and walking paths are envisaged.

- Sweden’s plan includes cycling in a very general pillar dedicated to local and regional climate investments, which “can be about everything from biogas and infrastructure, such as cycle paths, to the destruction of nitrous oxide and to replace heating systems from oil for district heating.”

Improved recovery plans

Several countries published updated versions of their recovery plans, with good news for cycling:

- Cyprus provided more details about the measures included in their already existing Sustainable Urban Mobility Plan (SUMP), where investments in the sustainable transport component now include: the development of pedestrian areas, 36km of new connected cycle networks as well as 4km of upgraded ones, safety for all road users with new cycle crossings and cycle hubs, creation of urban corridors, cycling parking and 30km/h areas.

- Czech Republic specified the budget addressed to business incentives for e-vehicles (€37 million), which include e-cargo bikes.

- Hungary clarified that €120 million will go to cycling infrastructure.

- Romania added cycling references in many investment sectors, including the establishment of a national bicycle coordination centre and the development of: 1) specific studies regarding cycling routes; 2) a national network of cycling tracks and cycling routes; 3) a national “E-Velo” platform, 4) multimodality with the adaptation of modernised wagons for bicycle storage; 5) the digitisation of bicycle tracks and routes.

No improvements

Since ECF’s last analysis in May, some recovery plans did not change or improve in terms of their cycling content.

- Ireland published a recovery plan, but it does not mention cycling.

- Luxembourg does not contain any relevant reference to cycling, even in the latest updated version of its plan.

- Finland and Germany did not update their plans, confirming their “red” category as containing no (relevant) mentions of cycling.

This brings the total of countries mentioning cycling in their plans to 21. Of these, 10 have good cycling content, while 11 mention cycling but leave room for much more (see table below), resulting in a final amount of €1.7 billion of the RRF dedicated to cycling investments.

Belgium is by far the country that dedicates the highest percentage of its national share of the RRF to cycling investments (7%), followed by Denmark (4.4%), Hungary, Latvia and Slovakia (tied at 1.7%), and Cyprus (1.4%). Five plans do not mention cycling at all (Finland, Germany, Ireland, Luxembourg, Portugal), while the Netherlands remains the only member state without a publicly available plan.

Overview table of National Recovery and Resilience Plans and their links to cycling: updated version (integrations in red)

|

State |

Description |

Investments for cycling |

km planned |

||

|

|

|

|

Declared |

Estimated* |

|

|

GOOD CYCLING CONTENT |

Belgium |

Dedicated investments of €746 million (55% covered by RRF) for cycling and walking infrastructure (bike sharing schemes, subsidies to local authorities for infrastructure development), with the aim to increase and coordinate efforts to develop safe cycling infrastructure (separate cycle paths and safer crossroads; attention to school environments); connectivity between cities and hinterlands with "bike corridors"; stimulate multimodality (with "Hoppinpunten": mobility points); Velo Plus project (cycle paths along the main roads, structuring and developing cycle routes along railways, canals, motorways. |

€411 million (7% of the RRF**) |

188 (new), 1,356 (to renew) |

|

|

Cyprus |

The implementation of the already existing SUMP has been inserted as an investment in the sustainable transport component and it includes: development of pedestrian areas, 36km of new connected cycle networks + 4km of upgraded ones, safety for all road users with new cycling crossings and cycle hubs, creation of urban corridors and cycling parkings and 30km/h areas. |

|

€14 million (1.4% of RRF) |

36 (new), 4 (to renew) |

|

|

Denmark |

Dedicated component on “Green transportation and infrastructure”, with an e-bike infrastructure scheme, cycling infrastructure investments on main roads and bicycle subsidy scheme for municipalities to make cycling attractive especially outside urban areas, developing a coherent cycling network. |

€70 million (4.4% of RRF) |

|

|

|

|

Hungary |

Dedicated investment for the development of the EuroVelo-compliant bicycle route (260km) especially for commuting purposes, to increase connectivity of remote areas and the competitiveness with the car, and a 950m long Danube bridge with cycle tracks on both sides. |

€120 million (1.7% of RRF) |

|

260 |

|

|

Italy |

Dedicated investment for the "Reinforcement of cycling mobility", with plans for cycling infrastructure maintenance and the realisation of new 1,200km of touristic paths and ~570km of urban cycle tracks. |

€600 million (0.3% of RRF) |

1,770 |

||

|

Latvia |

Development of cycling infrastructure for daily mobility with a unified, uninterrupted network to ensure local and neighbourhood connectivity + integration with the EuroVelo network. Integration of PT, cycling infrastructure and micro-mobility to serve the last mile. |

€34 million (1.7% of RRF) |

|

|

|

|

Malta |

Two reforms indirectly including cycling, such as the creation of more open and car-free spaces across Malta and Gozo and the adoption and implementation of policies promoting the sustainability of the transport sector, including by encouraging the use of multimodal transport; plus an investment directly addressed to the creation of purchase incentives for e-bikes in the private sector. |

|

€2 million (0.7% of RRF) |

|

|

|

Romania |

Construction, and operationalization of medium / long cycle routes, including EuroVelo routes, with the aim to create a national network; changing the legislation in force, by promoting a normative act on cycling routes. It also envisages the establishment of a national bicycle coordination centre, and the development of 2) specific studies regarding cycling routes; 3) a national network of cycling tracks and cycling routes; 4) a national “E-Velo” platform; 5) multimodality with the adaptation of modernised wagons for bicycle storage; 6) digitisation of bicycle tracks and routes. |

€120 million (0.9% of RRF) |

|

3,000

|

|

|

Slovakia |

Increase the share of cycling in the modal split by

|

€105.1 million (1.7% of the RRF) |

|

200

|

|

|

Spain |

It mentions a plan for sustainable, safe and connected mobility in urban areas; improve e-mobility (incentive for bike sharing schemes); establish low emission zones and to guarantee connectivity of people who live in depopulated or remote areas. Recently declared €3.6 billion for sustainable mobility measures, of which 2.5 are going to Autonomous Communities and Local Entities. |

|

€135 million (0.2% of RRF) |

|

|

|

CYCLING MENTIONED, but potential for a lot more |

Austria |

But it lacks in concretely defining cycling-related spending and projects. Define spending! |

- |

- |

|

|

Bulgaria |

Included measures for an urban mobility reform which includes the implementation of infrastructure for safe urban mobility aimed at vulnerable road users, namely pedestrians and cyclists. |

|

€1 million (0.02% of the RRF) |

|

|

|

Croatia |

€120 million action for “high-value tourism products” which includes investments for cycling infrastructure and the protection and development of active tourism, also with attention to the application of digital solutions on data monitoring for the rental/use of bicycles. But still no definition of cycling spending, and absence of cycling in the transport section. Define spending! |

|

€6 million (0.1% of RRF) |

|

|

|

Czech Republic |

Aim to reduce road fatalities with dedicated spending on road safety for vulnerable users (€23 million); set modal share targets for active modes in the SUMPS; implement reforms on road traffic (e.g. safe distance when overtaking cyclists); purchase premiums addressed to businesses for the purchase of 1,000 e-cargobikes (included in a €37 million package for e-vehicle incentives). |

|

€25 million (0.35% of RRF) |

|

|

|

Estonia |

Estonia included investments addressed to local authorities for walking and cycling paths, with €5 million of the RRF going for the development of 24km of cycling/walking paths. This implies 1) to complete walking/cycling connections with railway stations and public transport stops with the rest of the network; 2) development of paths outside the larger urban areas, that helps to eliminate bottlenecks that do not enable safe cycling. The investment is quite limited. |

€5 million (0.5% of RRF) |

|

24 |

|

|

France |

In the last version of the plan there is no more mention to specific cycling investments or active mobility in the transport component. The only clear mention to cycling is a reform for secure cycling parking in stations and the development of bike-on-train measures. Define spending! |

- |

- |

|

|

|

Greece |

The plan largely speaks about green tourism / ecotourism / non-seasonal tourism but the only cycling-related investment is the development of walking and cycling routes in the forest of Tatoi Be more ambitious! |

|

€4.5 million (0.03% of RRF) |

|

|

|

Lithuania |

Cycling is now mentioned also in the component "Component "Development of a sustainable transport system" which includes the development of walking and cycling infrastructure, but it still lacks of details in spending and concrete plans. Define spending! It also added the reform ”moving without polluting,” which sets specific targets for e-cars. Insert e-bike targets as well! |

- |

- |

|

|

|

Poland |

Punctual interventions to improve road safety, including cycling (in national roads). There are plans for building a coherent cycling network integrated with PT, but they have been moved from grants to loans. Without any earmarked funds, this is only words. Define spending! |

|

€14 million (0.06% of RRF) |

|

|

|

Slovenia |

The sustainable mobility component of the plan mainly focuses on rail and alternative fuels; cycling is explicitly mentioned only in the sustainable tourism section, where investments on cycling trails and walking paths are envisaged. |

|

€1 million (0.06% of RRF) |

|

|

|

Sweden |

Very general pillar dedicated to local and regional climate investments, which “can be about everything from biogas and infrastructure,such as cycle paths, to the destruction of nitrous oxide and to replace heating systems from oil for district heating." |

|

€25 million (0.76% of RRF) |

|

|

|

NO (relevant) REFERENCES: Finland, Germany, Ireland, Luxembourg, Portugal |

|||||

|

Not publicly available: Netherlands |

|||||

*= some countries foresee general envelopes for sustainable mobility. An estimation was based considering a realistic percentage of funding going to cycling on the basis of the interventions declared.

**= intended as each country’s share of RRF.

Regions:

News category:

Contact the author

Recent news!

Upcoming events

Contact Us

Avenue des Arts, 7-8

Postal address: Rue de la Charité, 22

1210 Brussels, Belgium